How AI Can Boost Predictive Maintenance In Manufacturing

How can Artificial Intelligence be used for predictive maintenance in manufacturing? New software technologies are helping business operations.

Despite the countdown to the planned departure of the UK from the EU now being measured in days rather than months, we are STILL not certain what form leaving will take and what will change if and when we do leave. However, there is still the prospect that the UK will leave with no arrangements in place which has implications for any company that does any business with the EU.

The Government has prepared contingency plans to help businesses manage a no-deal Brexit and this blog discusses how these changes can be managed within Microsoft Dynamics® 365 Business Central, and in its predecessor Microsoft Dynamics NAV.

There will be some major changes to the way VAT is handled but paradoxically, not with suppliers and customers based in the EU. In the event of no-deal Brexit, imports and exports to or from the EU would be treated in the same way as from the rest of the world. This would mean that VAT would have to be paid on all imports and then reclaimed later causing cashflow problems for importers.

To mitigate the effects of this, HM Revenue and Customs (HMRC) intend to extend the Reverse Charge arrangements so they will apply to all imports. This basically means that importers will no longer be charged VAT on imports but will have to reclaim the VAT as though they were charged it and account for that VAT as a notional sale in the same way as imports from the EU are. For transactions to and from the remainder of the EU, there will be no distinction between VAT-registered and non-VAT-registered persons and the EC Sales List submissions will no longer be required. Further information on the changes can be found here.

To set up the new arrangements in Business Central (or NAV), you need to make two changes. First, you need to change the VAT Calculation Type in your VAT Posting Setup screen for non-EU countries to Reverse Charge VAT and specify a Reverse Charge VAT G/L account. You also need to set the rates of VAT to their correct UK VAT rates. An example of how this might look is in the screenshot below:-

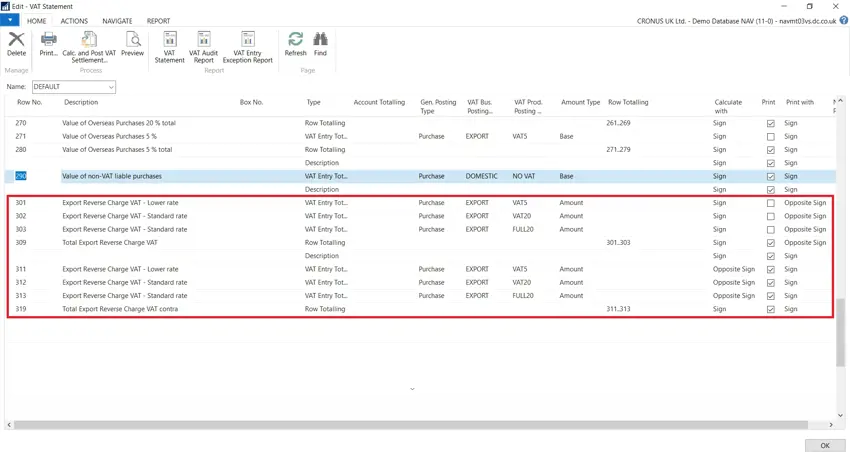

The next step is to change the VAT Statement so that the new Reverse Charge entries are included on the VAT Return. This involves adding some new lines on the statement along the lines of the one below:-

You would also need to adjust the Row Totalling of the lines on the statement that corresponds to the Box numbers of the VAT Return so they include these figures and add similar lines to account for the amounts net of VAT (the Base amounts in NAV). The VAT amounts need to be included in the Box 1 totals while the Base amounts should be included in Box 8.

In the event of a no-deal Brexit, it is envisaged that the UK in the short term would adopt the World Trade Organisation (WTO) tariff regime which would mean that tariffs would be imposed for the first time on a large number of imported items, particularly imports from the EU. Collection of the import duties would be made by HMRC using the same system as at present. Further information can be found here.

Dynamics 365 Business Central already has the ability to account for and pay import duties and also allocate the costs to your imported items using the standard Item Charge functionality. Further information on this can be found here.

In the event of a no-deal Brexit, especially if it was to take place on the planned leaving date of 29th March, there is likely to be a large fluctuation in the value of the UK Pound against the Euro and other currencies. This will expose businesses that trade with other countries to the risk of reduced profit margins or becoming uncompetitive. With Dynamics 365 Business Central and Dynamics NAV, you can easily change your currency rates as they change, keep track of your potential exposure to currency fluctuations and also accurately record realised gains and losses. More information is shown in this link.

If you need to discuss your options, then why not speak with our in-house experts? We may not know what the outcome of Brexit is going to be, however, we are well prepared!

How can Artificial Intelligence be used for predictive maintenance in manufacturing? New software technologies are helping business operations.

Summarising technology changes for manufacturing companies in 2023 and what that means for 2024 such as artificial intelligence and industry 4.0

Manufacturing, Warehousing and distribution company Colorlites implements Business Central ERP with Dynamics Consultants in a phased approach