How AI Can Boost Predictive Maintenance In Manufacturing

How can Artificial Intelligence be used for predictive maintenance in manufacturing? New software technologies are helping business operations.

This blog is relating to the latest update on the preparation for Making Tax Digital for Tax and VAT which will require UK VAT-registered companies to submit electronic summary VAT Returns for the first and subsequent VAT Returns for the first-period end after March next year.

There has been further clarity on the information that will be required to be submitted in the returns. These will have to be made electronically and HM Revenue and Customs still intend that the Return will need to include all the transactions that make up the Return. This second requirement will not apply however until after March 2020 so for the first year, only summary VAT data (basically the figures that would be included on the VAT Return) are required. Dynamics NAV® 2018 complies with this requirement already.

For users who have an earlier version of NAV there is an important concession from HMRC in that you can use intermediate software e.g. a spreadsheet to record the information you need to submit and use some form of API to transmit the information on that spreadsheet to HMRC. HMRC have an online submission API but also maintain a list of accredited APIs here and a large number of others are available.

There is still some uncertainty as to the formats that HMRC will accept for use with the API but it should be simple and in line with the format of the digital submissions that taxpayers can make electronically already.

The original HMRC guidance stated that you could not change any data emerging from your core ERP system. For example, if you needed to manipulate the figures generated from your ERP system for any reason you would not have been able to do so. This has now been relaxed so that you can add any adjustments you may need to make to your submission file (for instance a spreadsheet) manually. You still cannot make any changes to any data that originated from your core ERP system, however.

Microsoft customers will, of course, be supported. Dynamics Consultants have been working directly with Microsoft, HMRC and with one of our customers as a pilot to help shape the development of Making Tax Digital. On a recent call with Microsoft, it was confirmed that they are due to be added to the HMRC supporting suppliers list imminently. Through cumulative updates, Microsoft will be providing customers on supported versions of NAV (currently 2015 onwards) and Business Central any updates required to meet the regulations. We are able to help with applying cumulative updates, or upgrade systems to the latest version, as appropriate. If you are on an unsupported version of NAV and do not want to upgrade, we will likely be able to retrofit a solution to the requirements at a cost.

The following discusses how companies can use the existing solutions for the initial requirements from HMRC.

When the submission of transaction data becomes mandatory, there will be the problem of how to obtain the source data required without creating or amending it manually. NAV already has the ability to export a .CSV file of VAT Entries that could be used but it could be argued that this can be manually amended so would not be acceptable.

A more sophisticated way would be to set up an ODBC link between the VAT Entries table in NAV and an Excel spreadsheet. You could then run the ODBC query to extract the entries you needed to support the Return and include it in the submission without the need for any manual intervention.

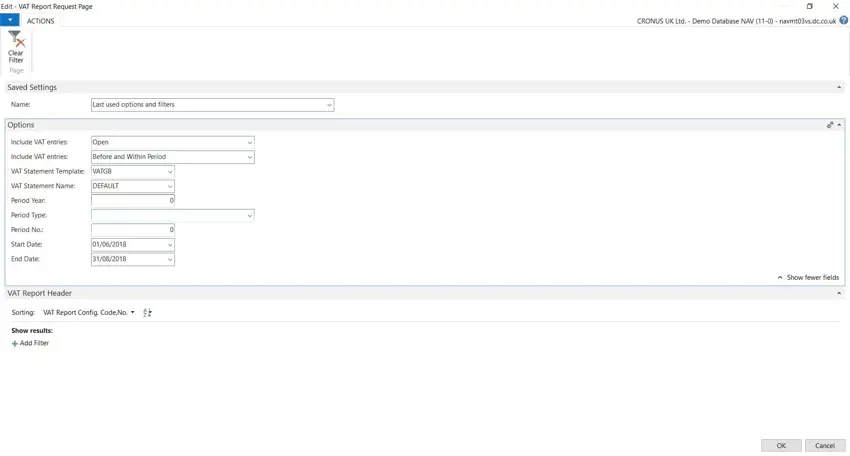

There was a potential problem submitting your VAT Returns via NAV in that the submission page was designed to use calendar months or quarters which may not coincide with a user’s VAT Return periods. There is a simple workaround as shown in the screenshot below:-

When running the Suggest Lines function from the VAT Returns card, you need to ensure that the Start and End Dates are visible (they are not visible by default). You then enter the dates of your VAT period in those fields.

There is a useful explanation of how MTD submissions will work in a variety of different scenarios from HMRC and this can be viewed here. There is also a more general overview of the area from the Chartered Institute of Taxation which can be viewed here.

How can Artificial Intelligence be used for predictive maintenance in manufacturing? New software technologies are helping business operations.

Summarising technology changes for manufacturing companies in 2023 and what that means for 2024 such as artificial intelligence and industry 4.0

Manufacturing, Warehousing and distribution company Colorlites implements Business Central ERP with Dynamics Consultants in a phased approach